Those who know me, know that I’ve been “insurance-free” for my whole career. My practice has been truly FFS (fee for service) for its entire history. I can tell you, that it has NOT been easy. But, when I observed the struggles of my insurance-based colleagues, it hasn’t been easy for them, either.

My friends deal with the vagaries of deeply discounted fees, rejected claims, lost claims, delayed payments, denied payments, down-coding, and demanding patients who expect them to know the intricacies of dozens or hundreds of plans, and so on.

My friends deal with the vagaries of deeply discounted fees, rejected claims, lost claims, delayed payments, denied payments, down-coding, and demanding patients who expect them to know the intricacies of dozens or hundreds of plans, and so on.

My challenge has been to attract patients who choose to come to my office because of the level of the service we provide rather than where their “insurance booklet” tells them to go.

Maybe I’m an idiot?

But, times have been tough. I have a lot of empty chair time. While my goal has never been to simply “be busy,” it’s natural to get worried when things are slow. And, as time has gone on, it seems people (patients) care less and less about quality of service and more about low cost and “does my insurance cover this?” There have been times where I doubt myself and think, “maybe I’m an idiot and should join some plans?”

But, times have been tough. I have a lot of empty chair time. While my goal has never been to simply “be busy,” it’s natural to get worried when things are slow. And, as time has gone on, it seems people (patients) care less and less about quality of service and more about low cost and “does my insurance cover this?” There have been times where I doubt myself and think, “maybe I’m an idiot and should join some plans?”

OK, maybe I should look into it?

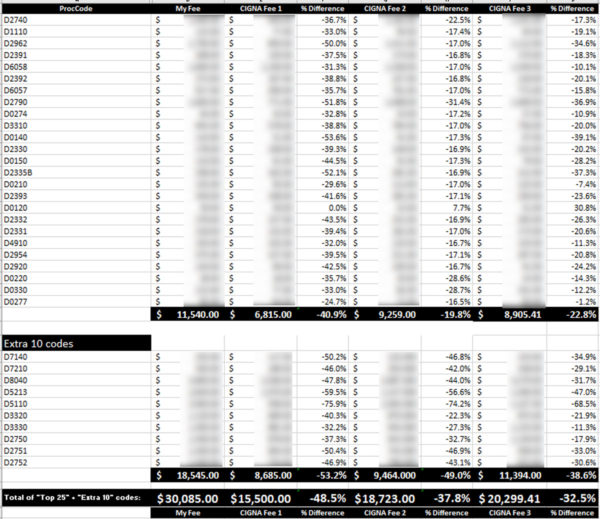

Last month I decided to at least look into it. I figured I’d at least get some information from one or two insurance companies about their PPOs. I started with Cigna. I had my office manager give them a call and ask for some information to be emailed to me. They promptly accommodated that request and emailed me a fee schedule.

I exported my fee schedule from my practice management software into an Excel spreadsheet. Then I took Cigna’s fee schedule home with me and had my wife dictate the fees to every single code to me, as I input them into another column in the spreadsheet. I then created another column with a formula to calculate the percentage discount for each fee.

You can click on the spreadsheet image below to see it in a larger format in a new window. You can see three “Cigna” columns, each representing the successive fee schedule offers. I have blurred out my fees and Cigna’s fees, as they are confidential. But, you can see the percentage discounts, which is the point of posting the spreadsheet.

At the bottom of each column, I totaled the fees to make an “aggregate fee” to give me an overall picture of the discount.

Ay, ay, ay! The PPO fees were DEEPLY discounted… 30 – 70%, averaging around 50%! See the column marked, “Cigna Fee 1” above. Yeah, that’s not going to work for me. I had learned that insurance companies will negotiate fee schedules a fair bit BEFORE you sign. So, let the negotiations begin!

Ay, ay, ay! The PPO fees were DEEPLY discounted… 30 – 70%, averaging around 50%! See the column marked, “Cigna Fee 1” above. Yeah, that’s not going to work for me. I had learned that insurance companies will negotiate fee schedules a fair bit BEFORE you sign. So, let the negotiations begin!

I don’t want to be busy LOSING money!

I shot an email back saying that those fees won’t work, and it was suggested that I submit my “Top 25” utilized codes and related fees to the insco. So, I did. Lo and behold, they sent me a new fee schedule with fees substantially improved for those “Top 25” procedures. They went from an average of a 41% discount (not doable) to a 20% discount (perhaps doable!). See column labeled, “Cigna Fee 2” above. Right off the bat, they improved the fees by about 50%! I was told in the insco rep’s email that I had 30 days to make a decision. I pretty much ignored it as a “standard” statement.

I shot an email back saying that those fees won’t work, and it was suggested that I submit my “Top 25” utilized codes and related fees to the insco. So, I did. Lo and behold, they sent me a new fee schedule with fees substantially improved for those “Top 25” procedures. They went from an average of a 41% discount (not doable) to a 20% discount (perhaps doable!). See column labeled, “Cigna Fee 2” above. Right off the bat, they improved the fees by about 50%! I was told in the insco rep’s email that I had 30 days to make a decision. I pretty much ignored it as a “standard” statement.

But, then I looked at the OTHER fees (outside the Top 25) and was disappointed. They only improved by about 4% to an average of 49%. So, I picked out 10 additional significant codes that, while not my top procedures, would add up to a substantial amount if I discounted them by 49% (not doable). While the Top 25 are the “head,” there is a “long tail” of procedures that, together, add up to a significant part of the practice revenue. Discounting the “long tail” by 49% is giving up a LOT!

I fired another email back and attached my spreadsheet with the “Extra 10 Codes” included. I expressed my concerns as I described in the paragraph above.

The Cigna rep sent back a third fee schedule proposal. See the column labeled, “Cigna Fee 3” in the spreadsheet above. Here’s where it gets a bit funny, because by now they should know they’re not dealing with an idiot. 🙂 I plugged the new numbers into my spreadsheet, and some of the Top 25 fees went back DOWN! They raised the “Extra 10” fees a bit: another 4%. But, they reduced the aggregate fees of the Top 25 by 3%! LOL!

The Cigna rep sent back a third fee schedule proposal. See the column labeled, “Cigna Fee 3” in the spreadsheet above. Here’s where it gets a bit funny, because by now they should know they’re not dealing with an idiot. 🙂 I plugged the new numbers into my spreadsheet, and some of the Top 25 fees went back DOWN! They raised the “Extra 10” fees a bit: another 4%. But, they reduced the aggregate fees of the Top 25 by 3%! LOL!

Sure…. we’ll raise those other fees a bit, but we’re going to lower some of the Top 25 fees!

The overall discount came to about 35%. Still a no-go for me.

I wrote back again, expressing my newest concerns, including in so many words, “I see what you did there!” LOL!

Call me maybe?

The rep tried to get me on the phone to “discuss.” But, I would rather get the entire conversation in writing (documented in emails). I sent another email asking if there was anything else we could do. She wrote back (yesterday) that the “custom” schedule had a 30-day expiration, and that 30 days was up on August 8 (tomorrow)!

Must buy now! Prices will never be better!

I was expected to make a major business decision by tomorrow! Well, that shit doesn’t fly with me. It’s like the car salesman telling you, “That price is good only for today. Tomorrow it goes up.” It’s a pressure tactic, and an obvious one at that. And, it really made my decision easy.

With tomorrow’s deadline looming, I sent this email today:

Hi Laura,

So, I have one more day to make a decision? A major business decision? I can’t help but be amused by the imposition of a deadline, which is obviously a pressure tactic. That you would resort to such measures tells me that the low fee schedule might be the least of my problems should I sign a contract with you.

I don’t suffer such tactics well. At the very least, this should be a mutually beneficial arrangement. But, you throw down the ultimatum – join now or else? I have no choice but to choose “else.”

So, I guess this is where we part ways.

Have a nice day.

It will be interesting if I hear back! If I do, I’ll update this article. In any case, they showed their true colors, and I don’t see myself joining the Dark Side. But, at least I gave it an earnest look. I’ll have to find other ways to fill empty chair time.

PS… If you need help in analyzing PPOs or improving your existing situation with PPOs, look to these experts: Unlock the PPO!

Copyright protected by Digiprove © 2019-2020 The Dental Warrior®

Copyright protected by Digiprove © 2019-2020 The Dental Warrior®

Good for you! I started FFS back in ’98 but cracked a few years back and signed on with 2 which was a mistake and I wish I had stuck to my guns like you. It’s too bad more people don’t realize this is what is happening with contracted insurance. Would you go to work tomorrow and have your company take 25-40% of your pay out of your paycheck? Of course not but sadly that is what most PPO’s do. But the general public at large doesn’t care because we’re all “rich dentists” anyway. So the answer for for most docs is to make it up in volume. I won’t argue with the potential pros and cons of higher volume. The problem is that as costs continue to rise even these models are becoming difficult to make a profit (Ooo…I said a dirty word…profit). Hence you see more courses now on 15 minute end and 10 minute crown prepping etc. While there’s certainly nothing wrong with being efficient at what point does it infringe on quality. Simple physics says that there is ultimately only so many procedures that can be done at one time by one person and going beyond that means something has to give. Hence you see lots of offices now having assisted hygiene where 2 and even 3 people are seen in an hour and some docs have 2 assistants for every procedure which is all fine and well again to be efficient but at what point does efficiency become cutting corners just to make the same profit (Ooo…there’s that word again).

Good article and good for you on sticking to your guns.

Thanks for your comments, Ken. I see one patient at a time. I’m not a multi-tasker! 🙂

I’ll be honest with you, i struggle with the same thing, but i’m younger than you. I bought my practice 3 years ago, and have been out of school for 7 years. Now i am in network with 2 insurances (delta and cigna, but only bc the fee schedule i was able to transfer over from my associateship was pretty good) and it’s been really slow to grow, and i’m constantly debating if i should just do it, but i fear once you go in, there’s no going back…I still dont know what to do, but i’m holding on to hope that by growing my practice this way, it’ll be better? who the hell knows, alls i know is that like you said, there are many days that i wish there were a lot more butts in the chair

I think it’s different for everyone. While it’s easy to say to another dentist, “you should do ______,” it really is folly.

Is it possible to negotiate with patients as to which procedures, YOU will allow their insurance to be submitted? Perhaps some patients really don’t need a lot of comprehensive work but would love to have maintenance covered by their plan especially if their plan is mostly covered by an employer (corporations used to offer dental at very low cost to employees). This may not be the case any longer.

(Sorry If If this Is a dumb idea)… I have no idea if it is even possible or would even provide any benefit for the dentist.

To my knowledge, it violates the insurance company contract (signed by the doctor).

To pay for a plan just to cover maintenance (cleanings) is a sucker bet. It would be cheaper (for the patient) to just be a cash patient. You’ll pay more in premiums than it will cost to just pay cash for preventive care. That’s not to mention you’ll be free to choose ANY dentist, not just the ones on the plan.

Makes sense. If it goes against contract, it’s not a consideration.

I guess I had a great deal with my employer. The cost to me was well below the cost of 2 cleanings per year. My thought was that perhaps the patient may develop a good relationship with staff and may decide to pay the extra out of pocket for a filling or crown, if needed…. or at that time seek a different provider. In the mean time, you have them coming to your office (but cleanings may not provide much profit). They may however, decide to do cosmetic procedures which are not covered by ins. anyway. Just a thought. Oh well.

HA! That’s a cute idea. The reality is that NO patient would ever do that. The mentality is that if they have so-called “insurance,” it should be “covered.” I doubt there is a dentist in the entire country that has had a patient do what you suggested. LOL!

I went for years to an office that did not “take my insurance.” I paid my bill (their asking fee), submitted the claim along with the receipt and was reimbursed by the insurance company… 100% for cleaning, 50% for crowns.

The Doctor never dealt with the insurance company. I did. I was always reimbursed as per contract. 100% maintenance, 50% on crowns. Don’t know about FL but this was standard procedure here.

I may have saved some money if I went to an office that “ took my insurance” (I.e. filed the claim for me so I would not need to cough up cash upfront), but not enough to make it worth my while.

So hah hah hah hah on me, I guess.

That’s different… not what you described earlier.

I was referring to patients with plans in which the doctor is “in network,” which is what I thought you were talking about.

In THIS case, your doctor isn’t in-network and isn’t accepting assignment. That’s pretty much what I do with the few patients I have with so-called “insurance.” I’m out-of-network, and not accepting assignment. Patient pays in full. Patient gets reimbursed by insco.

I should add that my dentist carried my insurance when I started with her. When she dropped my insurance, I started submitting the claims myself and got reimbursed by the insurance company. Since my employer paid the bulk of the insurance premium the cost of insurance to me was less than I would pay out of pocket for 2 cleanings per year. Granted, for a crown, perhaps I paid a bit more than 50% of the fee (but not much more), because there may have been a cap on the dollar amount, they would pay out. At that time, crowns were still “reasonably” priced. To me it was not a deal breaker. My dentist was well worth a few bucks difference.

Yeah. The whole idea about signing up with a carrier (as a business) and then negotiating with the patient which procedures you will do or not do on them as per plan was not a good idea. That was the silly part.

Best to just stay FFS, explain to potential patients, that they can get reimbursed if they file the claim themselves.

Stay FFS i say. But its a wicked world indeed for us dentists…

All the best!

AMEN! Dental insurance is destroying dentistry. I always wonder what the greedy insurance companies would do if all DDS’s finally stood together and said, “We’re not working with you anymore. Goodbye.” … it’s really just sad that what’s happening is mostly due to the fact that it’s a “every man for themselves” mentality. If everyone came together things could change.

Unfortunately, it’s against federal law for us to “come together” against inscos. So, it IS “every man for himself.” However, there is a “cattle herd” mentality among dentists. “If I don’t take the plans, the other dentists will, and they’ll get all the patients.”

I agree with Cambridge Dentist, stay FFS, thanks for sharing your story though as this is very relatable to dentists all over.

Thanks for your comment. The way I see it, I really don’t have much of a choice. If I’m to join any plans, I’ll have to change EVERYTHING I do. Every single thing. I think my head would explode, and I’d be a very unhappy boy.

But, I wanted to give the idea (joining PPOs) a fair shake by doing a real analysis of the fee schedule by using the spreadsheet. It was an eye-opener. I wonder how many (if any??) dentists do such an analysis?

Hi mike,

I have a different take on this issue. Whether we like it or not, insurance is here to stay. It’s quite common for any established office to hit a bottleneck, but especially hard for FFS ones because it’s hard to find new pt stream. We fixed most pts’ problems and accumulated a large recall pool, then they retired or moved etc, and we have empty chairs. Bottom line I think taking insurance or not is a pure business decision, if you take the emotion out of it, factor in your overhead %, will the reduced fee still give you profit over an empty chair (with a production of 0 ). You can probably limit it to one or two days a week to control the volume, and use a different mindset as compare to a FFS dentist. ie. If certain procedure is a potential loss you might refer instead of trying to do it. Obviously sometimes you will swallow a loss, but hopefully overall you come out on top. I believe you can sign on and drop off anytime, so try it for 6 months and do another tally, see if 1. it really help increase pt flow, 2. if the move generate profit without costing you too much headache, then decide if you want to continue. I feel alot of people complain of the reduction in fee, but yet I rarely see any of them decide to drop the insurance, so I think ultimately it probably is still beneficial to their office.

There might be more than one provider in your area, and they do have different fee schedule so you might need a do some more comparison, plus it will not hurt to do a tally of the potential pt you “lost” over the years because you did not take their insurance to see where is your potential pt pool.

There are a few other ways to try to increase new pt, sign up for some emergency service or open at odd hours is another way I’ve seen, though I am not sure if it will force you to change the way you practice more than taking a few insurances

Good luck

Thanks for your thoughtful comments. I agree, it’s PURELY a business decision.

Using a spreadsheet helped me visualize what I’d be discounting, not only on a code-by-code basis, but overall (with the aggregate totals). In the end, their best offer was an overall discount of 35%. The reality is that if I was to maintain the quality of care that I provide, an empty chair IS better than a patient at a 35% discount, because I’d be losing money. 0 is better than a negative amount.

Alternatively, I’d have to cherry-pick which procedures I could afford to do and simply quit doing procedures that aren’t profitable. I’d have to change every material I use. I’d have to change labs. I’d have to reduce the time spent with patients. And, so on.

I’d have to change the way I practice DRASTICALLY. And, I know myself. I would be MISERABLE. I’d have to lower my standards in every facet of my practice. I just can’t do it.

So… back to the drawing board! Joining PPOs just doesn’t seem feasible… from a BUSINESS perspective… for me.

Yeah mike, if your overhead is more than the reduced amount then it doesn’t make sense. I think most people are betting on more procedures in the top 25 codes than the others, but as you said, it will mean cherry picking… also like I said, it’s possible insurance wont bring much more pt flow to you, because John and Jerry and Jack down the street can all be accepting them all along, who is the say the pt will come to the “new guy”. Unless you know there is a potential pool from this insurance (eg, like a large local company or state workers etc) then it might be worth the trouble. Or check out other PPO, the fee is different every zip code I think, a better PPO at one zip code can be trash at another. When I used to work private 5 years ago, cigna was bad at my area (northern VA) and delta was the better one. Can be different for you I am not sure.

Another thing I’ve notice is some kind of discount plan. I came across it last year but I cant think of the name now. It’s a network where pt sign up for an annual fee and gets certain amount of cleaning and checkup a year, and 20% discount across the board for procedure or something like that. It is not an insurance plan so you can charge your own fee, just provide the discount to participants. I am not sure the provider side of the contract obligations, but seem like a better deal than a normal PPO. Combine something like that with maybe coupon for exam etc, maybe can increase the new pt flow, then use your “charm” for the rest 🙂

From what I can tell, zip code has nothing to do with it. Their fees are not just a little negotiable. They’re a LOT negotiable. If their fees were strictly related to zip code, they wouldn’t be so flexible. As my spreadsheet demonstrated, they went from an overall 41% discount to a 20% discount on the “Top 25.” But, beyond that, they start shuffling the discounts…. up in one area, down in another. From what I can see, it’s got nothing to do with zip codes. There are 6 zip codes within 1 mile of my office, so a single zip code mean nothing around here when it comes to demographics or other socio-economic metrics.

Dear OC,

Those discount dental plans aren’t lawful in every state, & here’s why. Unlike a true insurance vehicle, there is no cash reserve or bond required by the state. There are no insurance reviewers. It’s really easy to upsell patients on needless dental treatment, because there’s zero oversight.

Okay, please ask a doctor you trust, who has been at dentistry for 20-30 years. Ask them what % of other dentists in their immediate area they would trust seeing one of their family members. Believe me, they’ve seen the clinical care of their neighboring colleagues over many years of practice.

If they said they’d trust more than 50%, I’d be shocked. The number might well be under 10%.

So, if doctors w/ background, skill & knowledge are skeptical of colleagues, what chance does the general public have? Moreover, what chance does the public have working off that list of “qualified providers” offered by the insurance company?

10%?? Naaaa…. way lower than that for me. There are ~650 dentists in my county. I would say there are maybe a half dozen whose chair I would sit in. So, about 1%. Literally.

In my various capacities I get to audit all sorts of dental accounting books, especially in the DSO industry. These are generally obtained in legal discovery in the event a malpractice or fraud lawsuit.

The consumer fraud from the DSO industry I see actually exceeds the amount of Medicaid fraud from the DSOs, & that says a lot. A may DSO sign on w/ every PPO plan under the sun. Then they make up what they see as a loss leader, by upselling all sorts of needless dental care directly to patients. Any patient who doesn’t bite on the needless treatments is very quickly cut loose from the practice.

The sad thing the public doesn’t realize is that list of providers given them by low-end PPOs (or their work HR department) reads like a rogues’ gallery to a state dental board member or member of peer review. It’s the professional bottom-of-the-barrel listing. The insurance industry couldn’t care less. The hack & crooked clinics only make more profit. Employers give the illusion of offering a decent benefit. And, the public gets screwed.