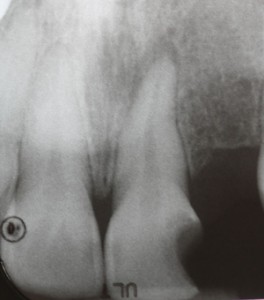

Today a 20 year-old came in as a new patient (husband and 8 month old baby in tow). She found me via my website and also cited my “good reviews.” Her chief complaint was a broken down tooth with a bump on her gum. It was #9. She had already lost #10, because “a dentist just pulled it.” She was wearing a flipper.

She said, “I know you’ll just have to pull this one, too. It’s really bad.” Maybe not. let’s take a look.

The tooth had a rather large carious lesion on the distal. There was a draining sinus tract on the facial gingiva. The PA x-ray predictably revealed an apical abscess. But, it was restorable. And, I told her as much. Her treatment choices were:

- Extract and add to her flipper. “You’d be losing ANOTHER front tooth.”

- Root canal therapy and a large composite or crown. “You can keep your front tooth.”

“But, I don’t have insurance.”

Yep. She said it. And, we’ve all heard it soooo many times. For most of my 25 year career, I’ve pontificated about how patients don’t need dental insurance because it’s not really insurance. In a nutshell, it’s a sucker bet and it’s a crap product. I’ve done the actual math for patients to PROVE I was right. And, in all those years, I don’t think I changed one mind.

Yep. She said it. And, we’ve all heard it soooo many times. For most of my 25 year career, I’ve pontificated about how patients don’t need dental insurance because it’s not really insurance. In a nutshell, it’s a sucker bet and it’s a crap product. I’ve done the actual math for patients to PROVE I was right. And, in all those years, I don’t think I changed one mind.

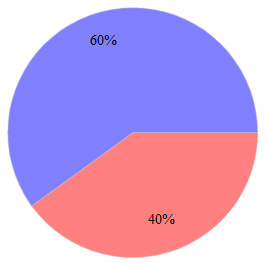

She’s a “sixty percenter.”

According to current figures, about 60% of Americans do not have a dental benefit plan (it’s NOT “insurance!”). Yet, the myth of “needing” so-called “insurance” is pervasive. If you ask people why they haven’t had PREVENTIVE dental care, they’ll say the same thing, “I don’t have insurance.” Aaaaaaaaaagh! Never mind that the cost of the provisions (read beer) they’ve acquired for this coming weekend’s Superbowl festivities is more than what it would cost them as a cash patient for two semi-annual recall visits. Maybe they have Superbowl party “insurance?”

According to current figures, about 60% of Americans do not have a dental benefit plan (it’s NOT “insurance!”). Yet, the myth of “needing” so-called “insurance” is pervasive. If you ask people why they haven’t had PREVENTIVE dental care, they’ll say the same thing, “I don’t have insurance.” Aaaaaaaaaagh! Never mind that the cost of the provisions (read beer) they’ve acquired for this coming weekend’s Superbowl festivities is more than what it would cost them as a cash patient for two semi-annual recall visits. Maybe they have Superbowl party “insurance?”

I’m a stubborn one, and it took 25 years for me to figure this one out. No amount of intellectual judo (or even math) will convince EVEN A SMART PERSON that dental “insurance” is nearly worthless. Even clever metaphors like “tooth of the year club” and “a gift card from a control freak“ do nothing to change their minds. To their very cores, they believe they MUST have “insurance” to obtain dental care.

If you can’t beat’em, join’em.

No. I’m not talking about joining “plans.” I’ve never signed a contract with an HMO or PPO, and I never will. Why would I join a race to the bottom to get the 40% of patients on those silly plans? Why would I abdicate my professional autonomy to a faceless company whose name adorns the tallest building in the metropolis? Why would I willingly undermine the precious doctor-patient relationship by inviting those mother-******s into it? Again… to get that same 40% all the other “plan dentists” are clamoring to get?

Oops… sorry about that. Got a little philosophical, and I’ll surely piss off some of my brothers-in-arms. Here’s my point. I’m talking about the 60% that don’t have ANY kind of plan, yet they feel LEFT OUT. They believe they can’t come to the dental party without their “invitation” (a dental plan). I’d rather have something that appeals to THOSE patients. What can I do to get THEM in the door and ANXIOUS to get treatment? How can I leverage their strongly-held belief that they need a “plan” and lead them to treatment?

Give’em what they want, and cut out the middle man!

So, how can I address the objection, “But, I don’t have insurance?” without sounding like a bloviating elitist? The answer: “We have an in-house savings plan that’s BETTER than dental insurance. It’s called Quality Dental Plan.” And, then I go on to tell them there are no premiums, no waiting periods, no denials, no claims to file, no annual maximums, no exclusions, and nobody interfering with their decisions about what’s best for them. “Jo-Ann can fill you in on the details and get you started saving money right away.”

And, it’s all true. Quality Dental Plan is a MUCH better deal for patients than any “insurance” plan.

It’s a no-brainer!

So, my new patient, the new mother who was convinced she would have to have her FRONT TOOTH extracted said, “So, you can make it look like a regular tooth?” My assistant interjected, “Dr. Mike is awesome. It will look like you got your natural tooth back.”

So, my new patient, the new mother who was convinced she would have to have her FRONT TOOTH extracted said, “So, you can make it look like a regular tooth?” My assistant interjected, “Dr. Mike is awesome. It will look like you got your natural tooth back.”

Jo-Ann then sat down with my patient and her husband in the consultation room and presented Quality Dental Plan. We’ve had 100% sign-up once they get the details from Jo-Ann. She signed up, paid the annual membership fee, and made the appointment for the root canal. Booya!

But, that’s not all!

There’s much more to this concept of an in-house savings plan. I implemented Quality Dental Plan just a few months ago. So, it’s still early in the race. But, so far, so good. I plan to write up a more thorough review of the concept and system in the future.

Update:

This patient did come in for her root canal and final restoration (large composite). She is SO happy! If it wasn’t for QDP, I’m quite certain she would have either had the tooth extracted or gone somewhere else.

Copyright protected by Digiprove © 2014 The Dental Warrior®

Copyright protected by Digiprove © 2014 The Dental Warrior®

It sounds enticing, Michael. But what keeps patients from joining and then dropping after they get the root canal?

Great question. First… if she did that (only the RCT), I’m OK with it, because I’d actually come out ahead when you add the annual membership fee + the RCT fee (with the savings factored in).

The reality is that patients are INCENTIVIZED to USE their membership much like a Costco membership. People don’t get the Costco membership and just buy one thing and quit. They come back for the giant tub of mayonnaise, pallet-sized bundle of toilet paper, and monster can of tuna, because they’re SAVING MONEY.

We’ve had one for a few years the concept of which I borrowed from another office. They can drop the plan I suppose, however since it’s a year long “contract” they’ve signed they’ll have paid for both their enrollment and the needed treatment so who cares? These really do work well. Do you talk about it on your website (main one), Mike?

You better believe I have a page dedicated to it on my website, Roy! 🙂 This is very marketable stuff!

There’s something I’m obviously missing. If there are no restrictions, what prevents adverse selection. That is, what’s to keep someone from demanding tens of thousands of dollars worth of dentistry in the first year?

“Demanding tens of thousands of dollars worth of dentistry in the first year” is a problem… HOW?

The patient will be paying for all that dentistry with a 10 – 20% savings (depending on how you’ve set up your plan). Again… how is this a problem? I would LOVE for that to happen EVERY DAY! 😀

Well put Mike! I have been saying this to patients for over 20 years myself.

Sorry, Michael. I simply misunderstood the financing.

So for a monthly fee of a hundred or so dollars (?), patients are simply guaranteed a 10 to 20% discount. Am I right?

Correct. So, the bigger their needs, it becomes an even better deal than “regular insurance”… a much better deal.

It all makes sense now. Thanks.

Amen, Dr. Mike,

Just out of curiosity, can you compare your experience with QDP to any of the other similar options? What made you decide QDP was right for your practice?

I can’t compare to any other “options,” since I have no experience with anything else. So far, I’m very happy with my progress. But, it’s still early in the game. But, already I’m seeing how the psychology of this works. It definitely makes me want to smack myself in the head.

Ive thought about signing up for this. As a FFS office, I have never tried to compete with any other offices based on price. they come to us for other reasons. One of my concerns would be all those patients I currently have that don’t have insurance, yet still come to me anyway. It’s a lot of people. I would think they would all sign up for this, and now I would be giving out discounts to alot of people that I wouldn’t have had to do without QDP. What are your thoughts on that? I’m also interested in hearing your experiences in the future on the results of people now seeking you out for cost reasons as opposed to quality/reputation, etc.

Hi Josh!

That’s a great question and a common “objection” from dentists. On the surface, the argument seems to make sense.

First… you are right that your own existing “cash” patients will sign up for this plan. Mine sure have. And, we make it a point to present it to all of them. The vast majority of my existing patients are cash patients. Only about 8% of my patients have a traditional dental benefit plan. So far, of the patients we’ve made aware of this program… 100% have signed up. It’s a good thing! Most dentists would think, “Oh no! Why would you do that?? They were paying you FULL FEES before, and now they’ll be paying LESS! OMG! OMG!”

Here’s the thing… MANY of our existing cash patients (yours, mine, and every other dentist out there) have PENDING treatment plans sitting in our file cabinet. If you’ve been a dentist for a while, you’ve likely heard the term, “file cabinet millionaire.” A typical established practice likely has $1 Million worth of treatment plans sitting in the file cabinet NOT BEING DONE.

With QDP, those existing patients now have an INCENTIVE to complete pending treatment. And, they’re far more likely to accept new recommended treatment at their recall visits. There are other benefits I’ll likely cover in a future blog post. Despite being early in the game for me, I can tell you that existing patients getting the savings benefits of QDP is a good thing.

How do you handle services you don’t provide?

Are there any regulatory requirements you/we have to beware of?

Hi Glen,

There is a stipulation in the plan that the savings apply only to services provided in our office. Since this is NOT “insurance,” it is not subject to those regulations. Obviously, each state has its own laws. I know that Dan Marut (founder of QDP) has extensive research for all the states. He could answer that question better than me. It’s not a problem for me in my state.

Thanks. I’ll check with him.

I’m just wondering what are the other mode of payment available. Do they have a monthly payment scheme aside from the annual payment?

James,

Yes. QDP has both monthly and yearly payment options available for patients. We discuss the benefits of each during our training.

Dan

hello, longtime reader, first time poster!

I just have a few questions about this program, I see the potential benefits. I also have a complete FFS practice. Many of my patients fortunately can pay the fees for crowns, and more involved services, but I want to explore a way to increase the availability of full mouth rehabilitation and cosmetic procedures to more of my patients. Those fees can get very high, and having a program like this may help them. do the patients pay “you” the membership fee? or do they pay QDP the membership fee? and how much is a typical monthly/yearly fee for the plan? and how does QDP profit from this arrangement?

Love your posts and insight Michael!

Thank you

Hi Brian,

Briefly… you charge whatever you want as the annual membership. You also set the terms of the plan. That said… QDP will train you and your team as to what is KNOWN to WORK. As a dentist member of QDP, you pay a monthly fee for training, marketing materials, and support. That’s it in a nutshell. Check out the QDP website.

Thanks Michael! will do

-Brian

Thank you for the great article Michael. This is an all too familiar scenario. You have an interesting outlook on dental insurance that few will admit to 🙂

Very interesting article. I also do not have dental insurance so this is definitely very helpful due to the fact that I am in the same boat.

Hi Mike, I am wondering why use QDP instead just do the in house discount on your own? Collect a fee, set the discount %, then adjust the fee accordingly for this pt. Seem like a clear head front desk with a calculator can do it 🙂 I suppose the marketing is the main reason? and you can only offer this to pt without any insurance correct?

Dr. Dan Marut (owner of QDP) figured out all the details of setting up and running an in-house savings plan. He’s also got the marketing stuff down (and provides a ton of material), including branding. Also they offer training and support for your team.

Honestly, I didn’t have the time nor the inclination to figure it all out. I’ve got so many plates spinning in the air as it is.

You can offer it to anyone you want. Though most patients with insurance will not likely do it.

First time hearing about QDP, I will have to do some further investigating. It seems like its been just over a year of you implementing, can you give an update as to how QDP is going? Have you seen revenues and profits increase? Or just the revenues?

After my first year, I can say that revenues were up slightly over the previous year. Of course, there are many factors at work, including the local economy (which has been TOUGH for the past 7 years). But, overall, I’m very pleased at the results from implementing QDP. Patients like it. And, it definitely encourages treatment acceptance.

We have been offering QDP to our patients for about a year now. As a dentist I’m a big fan. I recently had a patient thank me for offering QDP to their family. I can’t imagine ever being thanked for offering a PPO.

https://seasons-of-smiles.com/qdp-success-story-with-brad-dodge.htm

Mike,

Was wondering if you can give us all an update on your in office plan?

Still using and happy with QDP?

Have there been any negatives since you began?

DO you still recommend it?

Thanks,

Tom

I think it’s a smart move. Patients like it.

The only downside is that Florida has decided that we cannot market it, since (in their eyes) it’s too much like an insurance plan… even though it’s NOTHING like insurance. We can tell patients about it IN our offices. But, we cannot advertise it externally. Stupid.

So, yeah… still recommend it!